Contents:

Should global recession fears grow, the GBP/JPY could fall quickly on safe-haven flows. More recently, the yen has benefitted from safe-haven flows as fears of a global economic slowdown. Investors worry that if the US Federal Reserve hikes rates too aggressively, the US could fall into a recession, lifting safe-haven demand even higher. The surge in food, fuel and energy prices saw the Consumer price index rise to 9.1% year-over-year in May – a 40-year high.

Both cryptocurrencies and CFDs are complex how to use leverage in forex trading and come with a high risk of losing money. Fusion Mediawould like to remind you that the data contained in this website is not necessarily real-time nor accurate. Because of this, keep in mind that sometimes people will run to the yen when either rates overall drop, or if there is a major fear out there about some type of economic issue.

TRENDING

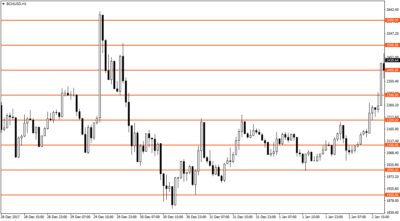

As we know all the pairs but mostly the JPY ones are reacting very well to the round and half-round numbers and being in a bullish scenario we still be long for a long order. Dear Traders, hope you are doing great, our last trading setup on GBPJPY dropped 300 PIPS, and we have not got an opportunity where price will fill up the liquidity voided area. Next week we have NFP where mix data is expected so JPY will be seen as heavenly safe currency for the investors and hence it will be an opportunity for all of us to have an perfect entry… The price perfectly fulfills my last idea and it went down from main resistance. I think that most likely, the price will make an impulse leg down and break through the range. I am waiting for the price bounce off the resistance to fix below the…

Our traders and analysts at Elliott Wave Forecast use Elliott Wave analysis as a part of our trading plan with a wide variety of technical trading tools and phenomena. For example, our traders and analysts have a daily technical check-list when analyzing any forex pair, commodity, stock, or any other asset class. Our traders and analysts conduct robust Fibonacci, Elliot wave structures, correlation, trendlines, market dynamics, sequences, and Elliot cycles analysis before calling a specific asset class bullish or bearish.

Most investors and traders persuade novice traders to trade GBP/JPY as their first instrument because this pair can teach lessons very quickly. Whether GBP/JPY will go up or down depends on the economic health of each country and their central bank’s necessity to tighten or weaken monetary policy. In addition to central bank action, the risk environment will help determine whether GBP/JPY will go up or down.

GBP/JPY – British Pound Japanese Yen

Bouts of volatility can be then compared to the typical outcome expressed through the averages. In this chart, the close price is shifted behind so it corresponds to the date when the price for that week was forecasted. This enables the comparison between the average forecast price and the effective close price. If not otherwise explicitly mentioned in the body of the article, at the time of writing, the author has no position in any stock mentioned in this article and no business relationship with any company mentioned. The author has not received compensation for writing this article, other than from FXStreet.

GBP/JPY Firms as BoJ Remains Dovish on Inflation – TorFX News

GBP/JPY Firms as BoJ Remains Dovish on Inflation.

Posted: Fri, 24 Feb 2023 10:30:00 GMT [source]

With this in mind, doubts are growing over how much more the BoE can raise rates. Western sanctions on Moscow tightened the energy supply, sending oil and gas prices higher. Ukraine is also an essential food producer, so food prices also jumped. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money. 84% of retail investor accounts lose money when trading CFDs with this provider. During Friday’s trading session, the GBP/JPY saw a lot of volatility as it fluctuated back and forth.

GBP/JPY

The gbpusd has created a rally since the previous lows while creating a double bottom ‘on higher TF’ so now it is currently going sideway treen on thos lower timeframe in which its gonna break soon as it jump higher. Together with the close price, this chart displays the minimum and maximum forecast prices collected among individual participants. The result is a price corridor, usually enveloping the weekly close price from above and below, and serves as a measure of volatility.

You might also pay a broker commission or fees when buying and selling assets direct and you’d need somewhere to store them safely. GBP/JPY has been falling in recent weeks amid growing doubts over how much further the Bank of England can raise interest rates. Meanwhile, the Bank of Japan , which is very dovish, could struggle to continue its current accommodative stance. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage.

Similarly, the Bank of Japan and the Japanese government release key data and make announcements during morning hours in Japan, with Japan Standard Time nine hours ahead of GMT. Furthermore, fears of a global recession as the US Federal Reserve hikes rates aggressively is helping boost demand for the safe-haven currency JPY. There are growing questions over the BoJ’s ability to keep defending this 0.25% cap on benchmark yields, as it looks increasingly out of line with the global environment. The yen has weakened, notably on the BoJ’s accommodative policy, which means rising import costs squeezing both businesses and consumers.

At this point, the question then becomes whether or not we can hang on to this momentum, or if we need to pull back in order to find more buyers. It is obvious at this point that the momentum is in favor of the https://forexbitcoin.info/, and it does look like we are trying to form some type of bottoming pattern. Nonetheless, it doesn’t mean that it’s going to be an easy shot higher. While it is possible to trade GBP/JPY around the clock, the best hours to trade the currency pair are when it’s experiencing higher trading volumes – typically around major market announcements. If we break above the top of the candlestick for the day, that more than likely will send this pair look into the ¥164 level, which of course is an area where we have seen some selling pressure previously. Above there, we have the ¥165 level, which is worth paying attention to as well as it is a large, round, psychologically significant figure and an area where we’ve seen some noise previously.

shifted price

We can see price has already started ts bearish move from the top of structure, and has already formed a continuation correction… UK GDP , the total market value of all final goods and services produced in a country. It is a gross measure of market activity because it indicates the pace at which a country’s economy is growing or decreasing.

Usually, the blue boxes signify the corrective sequences of the market we are trading. For instance, it represents and characterizes the 3,7 and 11 swings-to-end on our blue boxes. Such areas are considered highly low-risk areas, as they represent lucrative trading opportunities with a higher probability of working and a higher risk-to-reward ratio. Also – pivot points levels for Standard, Fibonacci, Camarilla, Woodie’s and Demark’s are supplied. Leveraged trading in foreign currency or off-exchange products on margin carries significant risk and may not be suitable for all investors. We advise you to carefully consider whether trading is appropriate for you based on your personal circumstances.

This profound type of analysis helps us attain more accurate price movements and a higher win rate. Moreover, such deep analyses on different asset classes, forex pairs, commodities, and stocks help us remain on the right side of the trend! This means we always try to trade within the trend and not go against it. Short-term pullbacks are likely to present buying opportunities, but it’s crucial to remember that the market is going to be very noisy. This is due not only to the Bank of Japan’s influence but also because this pair is sensitive to risk appetite, which is fluctuating heavily at present. This means that people may run to the yen when overall rates drop, or if there is a significant economic concern.

With that being the case, I think it’s probably only a matter of time before buyers run into a bit of a buzz saw, but if we were to break above the top of that shooting star, then the market could go looking to the ¥168 level. Ultimately, I think the only thing you can count on is going to be a lot of volatility. Below you will find the exchange rate predictions for 2023, 2024, 2025, 2026, 2027, 2028. Ultimately, the market has been bullish for quite some time, indicating that momentum will likely continue to be present in this market. However, it’s essential to keep in mind that when we spiked recently, we tested the top of a significant selloff, which will continue to be a major target. Breaking above this level is going to be incredibly challenging, and it’s unlikely to happen anytime soon.

Pound to Yen Forex Rate Prediction for Next Days

Producer prices, which measure inflation at the wholesale level, were also elevated at 22.1%. Producer price inflation is often considered a lead indicator for consumer prices, suggesting that inflation could rise further. The British pound has climbed across the year as inflation has risen and the BoE tightened monetary policy. Read on for the latest pound and yen news, as well as analysts’ GBP/JPY forecasts for 2022 and beyond. Make sure you do your research and based on your confluence please look for the entry. I see price touching Resistance multiple times then while breaking structure it created a demand then price retest with a pin bar on demand zone to go long..

By displaying three central tendency measures , you can know if the average forecast is being skewed by any outlier among the poll participants.

FXStreet and the author will not be liable for any errors, omissions or any losses, injuries or damages arising from this information and its display or use. The ¥162.50 level is also an area that has been signed previously, indicating that there is a lot of support underneath. The 200-Day EMA currently sits around the ¥162 level, with the 50-Day EMA set to rise above it, which could kick off a “golden cross.” We appreciate passion and conviction, but we also strongly believe in giving everyone a chance to air their point of view.

- The British pound has rallied quite significantly against the Japanese yen during the trading session to slice through the ¥160 level yet again.

- The author and FXStreet are not registered investment advisors and nothing in this article is intended to be investment advice.

- The gbpusd has created a rally since the previous lows while creating a double bottom ‘on higher TF’ so now it is currently going sideway treen on thos lower timeframe in which its gonna break soon as it jump higher.

- JPY is often used as a funding currency of a trade because it’s historically a low yielding currency.

Generally speaking, a high reading or a better than expected number is seen as positive for the GBP, while a low reading is negative. Bank of Japan that issues statements and decides on the interest rates of the country. The BoJ has been applying very low interest rates for many years and even introduced a negative interest rate in January 2016, in an attempt lift consumer prices, which have been sliding for most of the past 20 years.

When it does happen, the market could really start to take off to the upside, go looking to the ¥170 level. GBP JPY Pair found buyers in the blue box and rallied nearly 200 pips in the form of 5 waves impulse over the course of next few days allowing any traders who bought the pair in the blue box to move stop to entry level. You can still benefit if the market moves in your favour, or make a loss if it moves against you. However, with traditional trading you enter a contract to exchange the legal ownership of the individual shares or the commodities for money, and you own this until you sell it again. Whether GBP/JPY is a buy or a sell is largely dependent on the BoE’s ability to keep hiking rates and the BoJ’s ability to stick to its dovish stance.

I do believe that eventually we will have to make a bigger decision, but right now it seems like this can be more noise than anything else. The ¥165 level above could be a potential target since the market pierced it previously, only to turn around and experience a significant downturn. However, the situation is heavily influenced by the Bank of Japan, which is going to continue to keep interest rates low in their country. GBP/JPY has a positive correlation with the Nikkei-225 Japanese index.